You are a business and real estate owner. You may have spent the better part of your life building and maintaining your business, and are evaluating retirement. Or, you’re a serial entrepreneur ready to develop your latest business venture. Or, perhaps, the changing demographics have created a situation where your business is better suited for another area, or re-purposing your real estate could unlock its value. Either way, if you are considering making a change, you have a few options to consider.

Lease Your Property

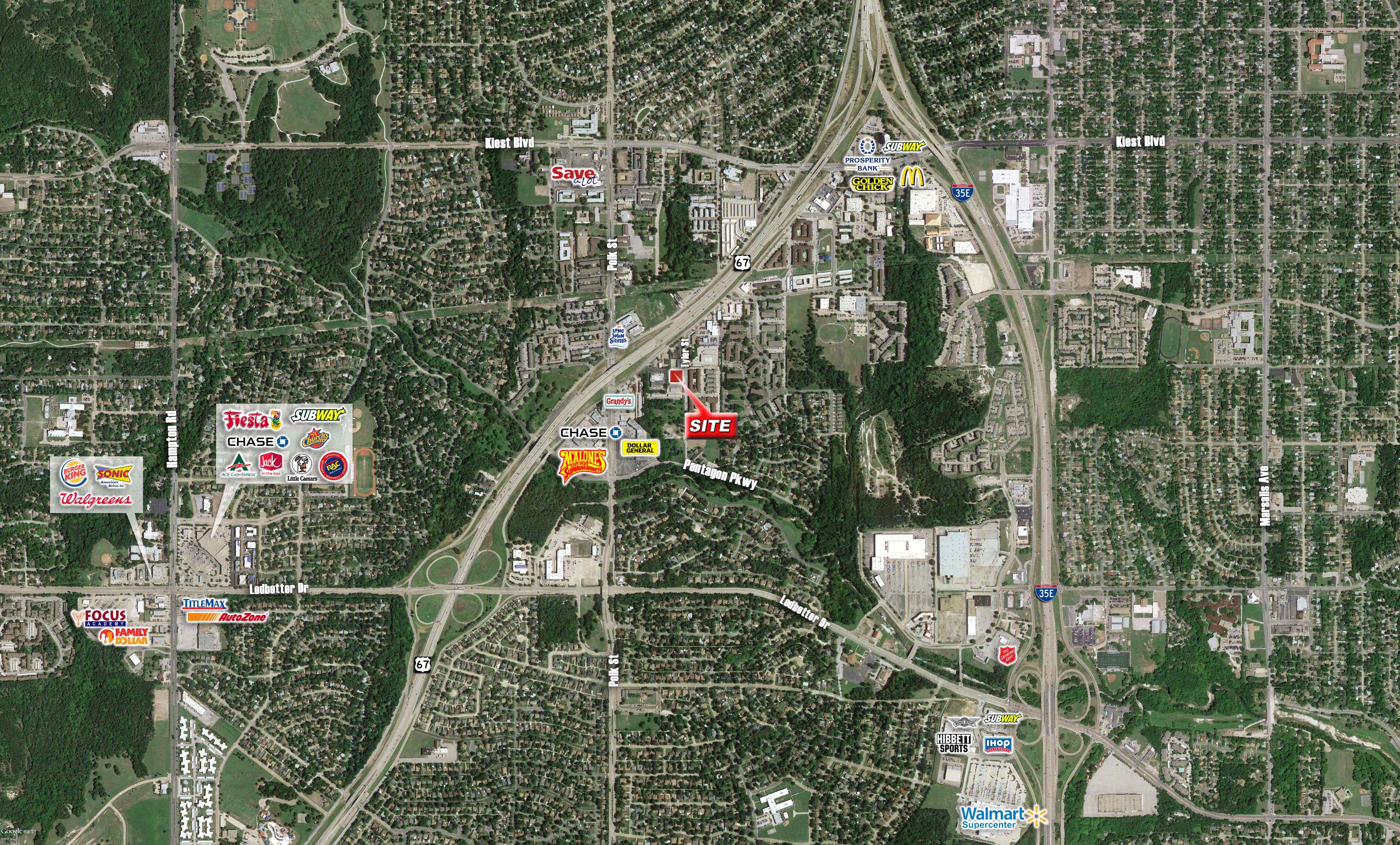

The advantages to relocating or closing your business and relocating your property is that you become a passive investor, setting yourself up to receive “mailbox money.” If your property is located in an area, such as North Oak Cliff, that has experienced an increase in property values but there remains a great deal of upside potential, this may be your best option.

However, becoming a landlord can be somewhat complicated. For example, if the location where you have housed your auto repair business is better suited for a restaurant use, you could stand to realize upwards of $20/SF plus 6% of the revenues (in excess of a negotiated break point). However, expect the conversion cost to be somewhat expensive. The tenant may request a finish-out allowance, and/or require a relatively long term lease to protect the cost of their investment.

Sell Your Property

Generally, selling your property is the simplest of the available options. Developers or business owners will typically evaluate their offer price based on the market lease rates given your property’s highest and best use. For example, if your property is 3,000 SF and the market rent rate is $17/SF NNN, its value, based on a 10% capitalization rate is approximately $500,000 less the cost of improvements necessary to generate the market lease rate. Business owners or developers may have different proposed uses, which would dictate the value to them. Therefore, the property may be worth more to one prospective buyer versus another. This makes it important to market your property broadly to expose it to the highest number of prospective buyers.

Sell Your Business

The sale of the business is an often overlooked option, particularly if you are speaking to the typical Commercial Real Estate Broker who doesn’t offer this type of service, but one that is important to consider as its not uncommon that your business has value that may be in excess of the real estate, or there is value that may remain after the business has relocated. One of the most important things to consider is that the value of your business is typically based on its cash flow, and maintaining good records is crucial. Also, when establishing the asking price of your business, it is important to understand the various variables including market EBITDA multiples, inventory valued at cost, the value of extended non-compete agreements, recurring revenue sources, management team in place, etc. Obviously, the sale of your business is the most complicated, but perhaps the most lucrative option, which deserves adequate consideration.

If you foresee a change in your future, please call me for a free consultation to assist you in evaluating your options.